📱 MOBIKO PWA – How Is the MOBIKO App Structured and What Do the Sections Mean?

🏠 Home Screen of the MOBIKO App – What Do the Different Sections Mean?

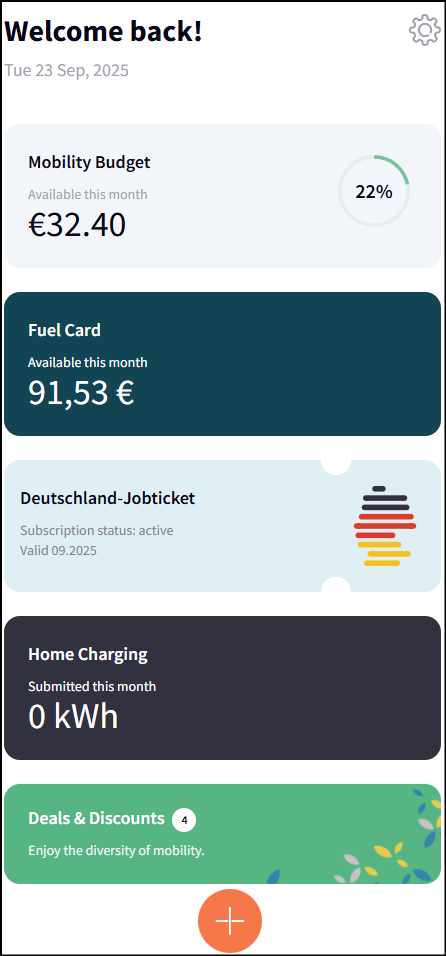

When you log in to the MOBIKO app (PWA), the home screen gives you an overview of your current mobility benefits. Here’s what each section means:

💸 Mobility Budget

Shows the amount you still have available for the current month.

The circle next to it shows, in percent, how much of your budget you’ve already used.

⛽ Fuel Card

If your employer provides you with a digital fuel card, this section displays the available balance for the current month.

🚆 Germany Job Ticket

If you receive a Deutschlandticket via your employer, you’ll find your subscription status and validity period here.

🔌 Home Charging

This section shows how many kilowatt-hours (kWh) you’ve already submitted this month for charging your electric vehicle at home.

🎁 Deals & Discounts

Find exclusive deals and discounts related to mobility – such as bike leasing, sharing services, or wallbox purchases.

✅ Tip:

Clicking on the individual cards often reveals more information or takes you straight to the appropriate submission form.

📸 Sample screenshot:

🚲🚆🚗 Module: Mobility Budget – Overview of Your Monthly Budget & Status

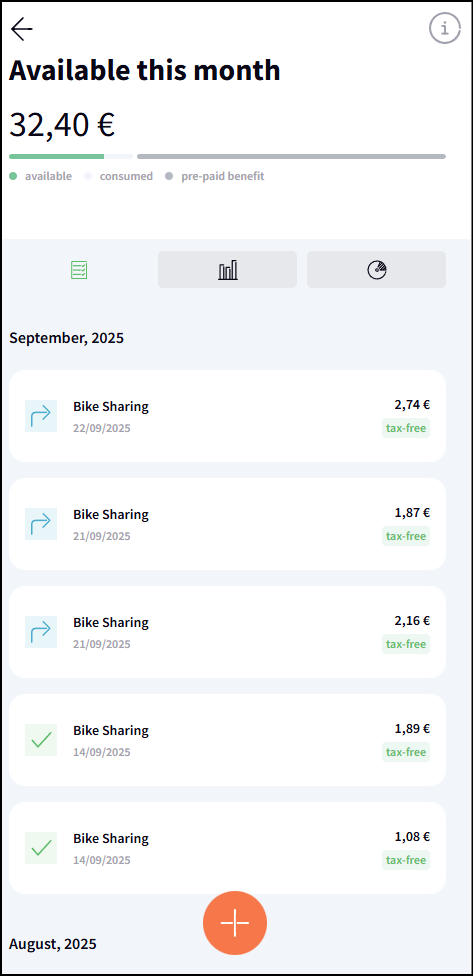

🗒️ Tab 1 – Detailed List of Your Expenses – Main View

🗒️ Detailed Overview of Your Expenses

In the “Mobility Budget” section, you’ll not only see your current remaining budget, but also a chronological overview of all mobility expenses you’ve already submitted and had approved.

📸 Sample screenshot:

Budget – Available This Month

Displays the amount you can still use for the current month.

Progress Bar with Legend:

-

🟢 Green (available): Your remaining budget

-

⚫️ Gray (consumed): Already spent

-

⚪️ Light gray (pre-paid benefit): Budget that has already been deducted in advance, e.g. through a company subscription

Monthly Overview Below:

-

Sorted by month – you can view expenses from the current and previous months.

-

Each entry includes:

-

Mobility category (e.g. public transport, bike sharing)

-

Date of the expense

-

Reimbursed amount

-

Tax status (e.g. “tax-free”)

-

Status icon (e.g. ✔ for approved, ⏳ for pending)

-

✅ Tip:

Click the “+” symbol to upload a new receipt and assign it to your mobility budget.

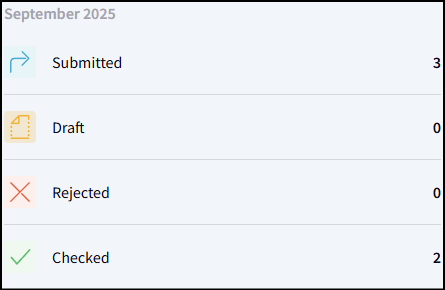

📊 Tab 2 – Receipt Status Overview – Side View

📑 Receipt Status Overview

In the 2nd tab of the MOBIKO app, you’ll get a quick overview of all your receipts – whether they are submitted, in progress, saved as drafts, rejected, or already approved.

The following receipt statuses are displayed:

📤 Submitted

Receipts you’ve successfully submitted and are currently being reviewed.

📝 Draft

Receipts you’ve started but not yet submitted – you can edit and submit them at any time.

➡️ Only submitted receipts can be reviewed and approved.

❌ Rejected

Receipts that were not approved – for example, due to incorrect category selection, missing information, or lack of documentation.

👉 Tip: Click on the receipt to see the reason for rejection.

✅ Approved

Receipts that have been fully reviewed and approved – the amount (tax-free or taxable) has already been or will soon be reimbursed.

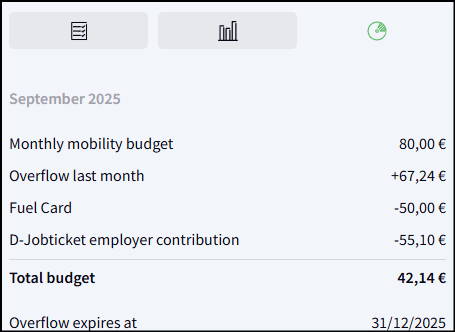

🧩 Tab 3 – Budget Breakdown & Your Allowed Mobility Categories – Side View

Tab 3 – Budget Breakdown & Your Allowed Mobility Categories

Under the third tab in the MOBIKO app, you will find an overview of all mobility categories your company has approved for you. This way, you can see exactly which types of mobility you can use and charge to your mobility budget.

History of Your Mobility Budget

Under "Total Budget," the following are shown:

-

Your fixed monthly mobility budget

-

Any carryover from the previous month

-

Deductions such as fuel card usage or subsidies for the job ticket

Example image:

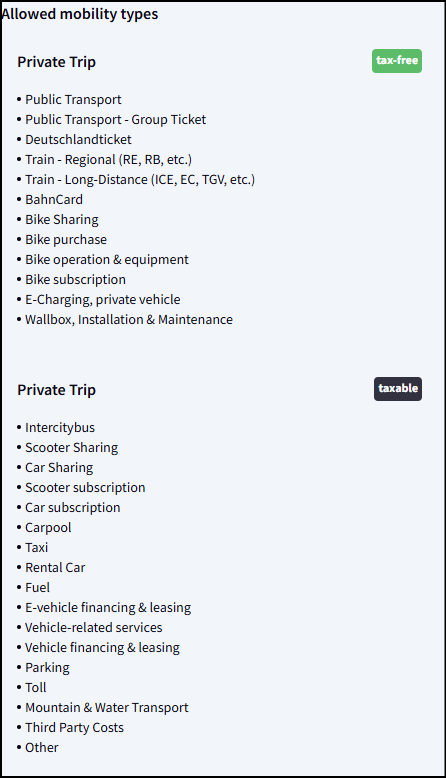

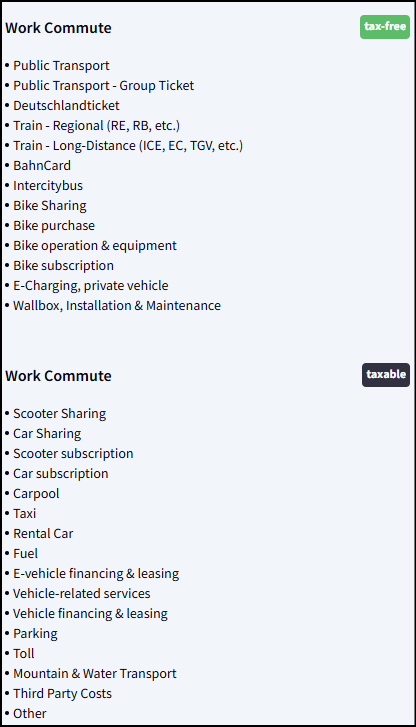

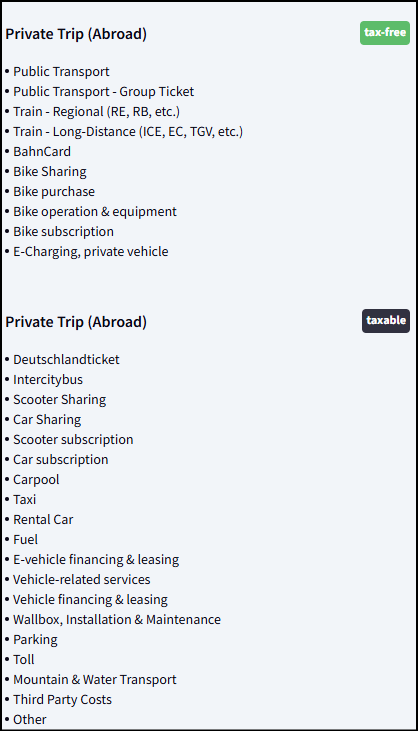

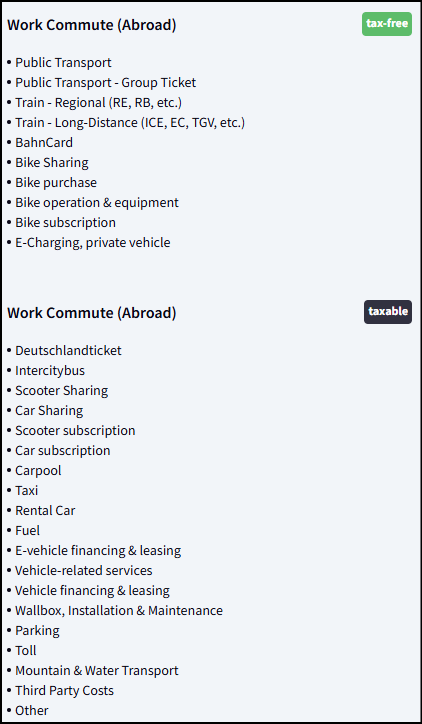

✅ Your Allowed Mobility Types

Depending on your company’s approval, you will see an overview of the approved mobility types, divided into:

-

Private trips (tax-free)

-

Private trips (taxable)

-

Commute trips (tax-free)

-

Commute trips (taxable)

-

Foreign trips with respective tax classification

Important: ALL mobility categories shown in your overview have been approved by your HR department. You can therefore use them without concern — categories not approved will not be displayed.

Example images:

ℹ️ - Button

These details are always accessible via the Info Button within the MOBIKO app, directly in the area of your mobility budget. This way, you always have important guidance on how to correctly submit your receipts at hand.

How to correctly submit receipts and specify the trip purpose

Number of submitted receipts

You can submit as many expenses as you like — this can only work to your advantage! We optimize which expenses are reimbursed in the following order:

-

tax-free

-

tax-privileged

-

taxable

Even if your budget is exceeded, don’t worry — amounts can be split. Submit all your expenses for your mobility types to get the most out of your budget.

Correct billing address

If the receipt shows a billing address, please ensure your private address is listed, not your company’s address.

Invoice date or trip date

The invoice date usually corresponds to your trip date and must match the current month. The invoice date is decisive.

Available mobility types

You can see which mobility expenses you can generally submit under the “Mobility type” section when entering a receipt.

Costs for other passengers

If your receipt includes costs for additional passengers, no problem! Submit the receipt and record only your personal expenses. Other costs should be entered under “Costs for third parties.”

Submitting public transport subscriptions

Annual public transport subscriptions billed monthly can be submitted without issue. Please enter your monthly invoice or direct debit.

Tax-related information

-

Taxable:

For taxable subsidies, you are responsible for paying income tax and social security contributions yourself. Therefore, you will not receive the full amount reimbursed. -

Tax-free:

For tax-free subsidies, you receive the full amount of your expenses reimbursed (up to your budget). These are exempt from social security contributions and taxes.

Correctly specifying trip purpose and origin

-

Private trip:

Trips during your leisure time or not to your workplace count as private trips. Example: Taking the subway into town for shopping. -

Business trips:

Business trips cannot be reimbursed via your mobility budget. -

Commute:

Trips between home and workplace count as commutes and must be submitted as such for tax reasons. Example: Taxi from home to work. -

Domestic trips:

Trips that start and end within the country count as domestic trips. Trips starting in the country and ending abroad are also included here. -

International trips:

Trips that start or end abroad count as international trips. Trips starting abroad and ending in the country also fall under this category.